They say ignorance is bliss. For market participants who buried their heads in the sand for the first six months of 2025 and are just now emerging to check their statements, it will appear to have been a very ho-hum start to the year. Meanwhile, the rest of us have been pulling our hair out for six months trying to separate the signal from the noise. And there has been a lot of noise!

In financial market terms, signal refers to real change in economic conditions that will have a lasting impact on the future cash flows of a given asset class or financial markets. Signals are what we should be paying attention to and reacting to as market participants. Noise is just as it sounds, all the other hyperbole that can lead to short-term market volatility, but ultimately has no lasting impact on future cash flows for financial instruments.

To start the year, we noted that the economy appeared to be headed for a soft landing and that the outcome would depend largely on the new administration’s various policies and how they counterbalance one another. Here’s how we see things shaping up at mid-year in regard to what is actually signal versus noise:

- Tariffs – Very noisy, signal still unknown, but may be the most impactful. By mid-April, stocks were down nearly 20% largely due to the initial round of tariff announcements. Final levels have yet to be determined. It appears we will see a substantial increase, resulting in a drag on economic growth and placing upward pressure on inflation.

- Tax Cuts – A lot of noise coupled with some signal. Labeling something the “Big Beautiful Bill or BBB for short” is about as noisy as it gets for a bill that does not really change a whole lot. Still, the tax cuts are stimulative to growth in the near term, and there is clearly some negative signal for green initiatives.

- Deregulation – Mostly signal. There really has not been much made of deregulation efforts so far, but just from our perspective in the banking industry, there is clearly an effort to ease the burden of regulation. This should be stimulative to growth in the near term.

- Immigration Reform – Mostly noise. While enforcement has intensified and deportations increased, we have not seen the massive levels of deportation promised that would have had an immediate impact on financial markets. In the long run, stricter immigration will impact the labor force, leading to potentially higher inflation and less economic growth.

- DOGE – Extreme noise with very little signal. The chainsaw antics coupled with $2 trillion in promised cuts somehow fizzled out with about $150 billion in savings and an epic spat between the President and the world’s richest man.

Equity markets, as they often do, got caught up in the noise earlier this spring as the S&P 500 Index fell nearly 20%. We had warned about valuation and concentration issues surrounding the Magnificent 7 and domestic large-cap issues back in January.

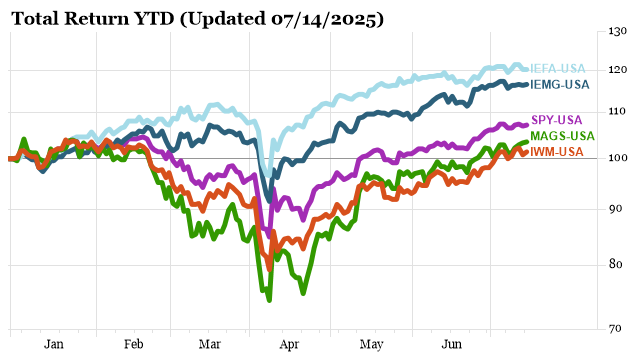

As you can see from the return chart below, the Magnificent 7(MAGS) did lead markets lower in the spring, falling more than 25%, but rebounded back into positive territory with a 1.93% return by 6/30/25. This trailed the S&P500 Index (SPY), which fell just under 20% before rebounding to a 6.2% return by mid-year. Our diversification strategy worked somewhat for the first half of the year, with International Developed (IEFA) (+8.26%) and International Emerging (IEMG) (+11.09%) both outperforming the S&P 500 Index through the first 6 months. Small-caps (IWM) still trailed with a -1.79% return for the period.

Markets are back near all-time highs, and valuations are once again stretched. Looking to the second half of the year, tensions continue to mount on the geopolitical front. With this in mind, we continue to suggest well-diversified portfolios with a slight underweight to growth and the Mag-7.

.png)