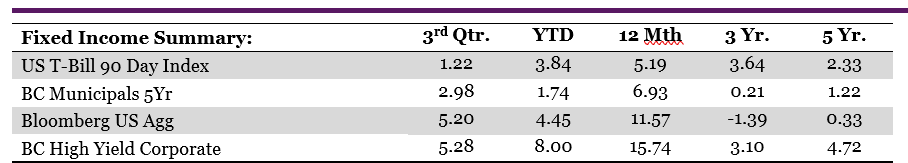

Entering the third quarter, the US bond market was negative YTD on a total return basis. After an about face and a strong quarter, the total return for the Bloomberg US Agg was up YTD 4.45% by the end of the quarter. This was fueled by a 50-bps cut by the Fed at the September meeting with the expectation of additional 25-bps cuts at both the November and December meetings. The 2-Year Treasury yield fell more than 100-bps to end the quarter at 3.641% while the 10-Year yield fell more than 50-bps to 3.786%. After these significant moves in interest rates, the 10 to 2 Year spread finally turned positive ending an over two-year inversion that many thought was destined to lead to a recession.

As we mentioned in the last bulletin, we anticipate the longer-dated maturities to remain rangebound. With this in mind, we have decreased our duration in portfolios to align closer to the benchmark. We traded this interest rate risk for some credit risk by increasing our investment grade corporate exposure. High yield bonds continued their positive performance in the third quarter; however, credit spreads are still tight compared to historical norms. We continue to monitor this and will add exposure to when spreads are closer to their long-term averages.

Overall, fixed income markets continue to provide steady income and capital appreciation opportunities. We continue to overweight to fixed income taking advantage of the increased yields and providing negative correlation to equity risk.

As we mentioned in the last bulletin, we anticipate the longer-dated maturities to remain rangebound. With this in mind, we have decreased our duration in portfolios to align closer to the benchmark. We traded this interest rate risk for some credit risk by increasing our investment grade corporate exposure. High yield bonds continued their positive performance in the third quarter; however, credit spreads are still tight compared to historical norms. We continue to monitor this and will add exposure to when spreads are closer to their long-term averages.

Overall, fixed income markets continue to provide steady income and capital appreciation opportunities. We continue to overweight to fixed income taking advantage of the increased yields and providing negative correlation to equity risk.