The economy may be stuck in the same old story, but the stock market has changed tunes. The third quarter brought about some long overdue rotation. All stocks performed well during the quarter with most indices making new highs. However, there was a noticeable change in leadership.

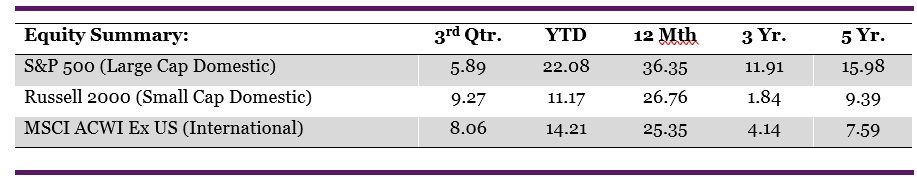

Small stocks as represented by the Russell 2000 Index, returned over 9% for the three-month period. International stocks also did very well, returning over 8% as indicated by the MSCI ACWI Ex US index. For once, it was the S&P 500 Index that trailed the other markets. However, the large cap domestic index still returned nearly 6% and made a new high above 5800 during the quarter.

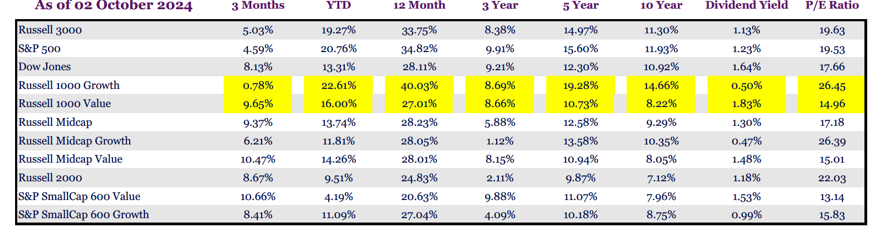

The expanded list of domestic stock indices below shows a start contrast in the performance of growth vs. value stocks during the quarter. Large Cap Value outperformed by nearly 9%.

Small stocks as represented by the Russell 2000 Index, returned over 9% for the three-month period. International stocks also did very well, returning over 8% as indicated by the MSCI ACWI Ex US index. For once, it was the S&P 500 Index that trailed the other markets. However, the large cap domestic index still returned nearly 6% and made a new high above 5800 during the quarter.

The expanded list of domestic stock indices below shows a start contrast in the performance of growth vs. value stocks during the quarter. Large Cap Value outperformed by nearly 9%.